Last week, as timed with Steam Machine's public reveal, we at Digital Foundry were able to pore through spec sheets, review our hands-on impressions and make guesses about comparable AMD parts that are likely being used for Valve's new living-room box. But now, we come to a less clear period of asking questions ahead of the system's launch in "Q1 2026."

Our attention turns to a matter that may make or break Steam Machine's sales potential: how low will Valve go to price this living room box? Let's tease out what we publicly know, what we feel comfortable guessing and what Valve ultimately has to weigh before telling us Steam Machine's price.

As a reminder, we're in unprecedented territory, as Valve's own hardware announcements for the past ten years have always come with price points attached - with the original Steam Machine line being an exception in 2014, since that was announced as a line of PCs with prices set by participating OEMs like Alienware and Falcon Northwest. Everything else, from Steam Controller to Steam Link to Valve Index to Steam Deck, has included a price in its public reveal.

It's indicative of the unprecedented tariff-induced chaos that has rocked every console manufacturer, along with rising storage and RAM prices. Hiding Steam Machine's price for at least a few months ahead of launch aligns with that reality, especially as we wait to see whether Valve's new system is classified as a "PC" (a term used broadly in its advertising) or as a "console." In the latter case, it'd be hit by the same US tariff schedule as current Nintendo, Sony and Microsoft systems imported from China or Vietnam.

If the updated Steam Machine will face a revised tariff condition by "Q1 2026," Valve is wise to avoid making a price promise it can't necessarily keep - or, conversely, pass as much savings to customers thanks to further tariff revision as possible.

That's the biggest external weight hanging on any price Valve eventually announces, but in reviewing our recent conversations with Valve staffers, the term "tariff" didn't came up. Instead, we heard a lot about "affordability." Valve had the opportunity to offer warnings about the realities of global markets and the supply chain, and thus prepare its customers for sticker shock, but it opted not to.

The company's official line about Steam Machine's specs are that they're an "upgrade" for the average Steam user, as per the Steam Hardware Survey. (As we've reported, the entire Steam Machine spec has been built around those Steam Hardware Survey findings.) Are they? And if so, how does that affect the kind of price Valve might set?

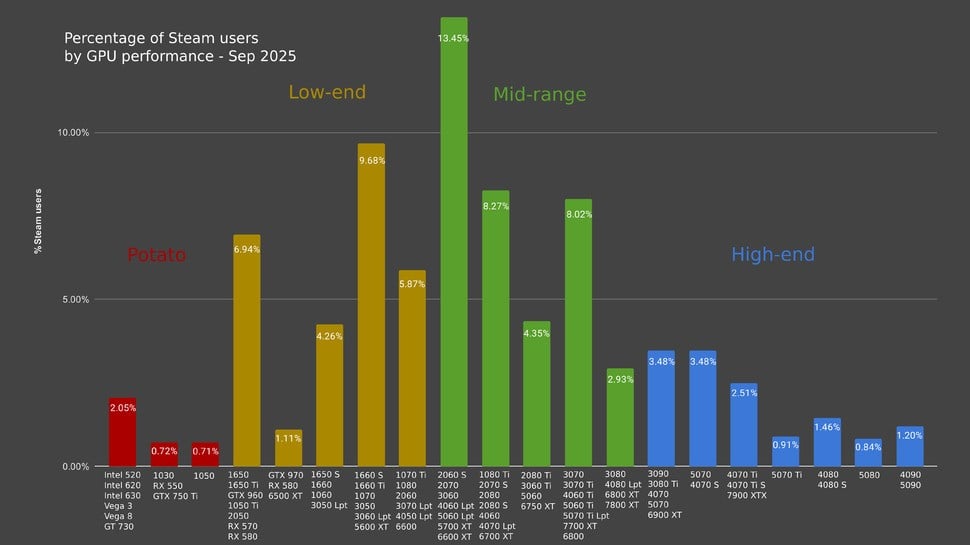

Let's look at a slightly more focused version of Valve's publicly known data to make a determination. Recently, Reddit user seyedhn broke down Steam Hardware Survey results by relative GPU performance level, and its determination mostly aligns with our own GPU-review findings.

Based on that chart, Steam Machine's slightly cut-down AMD RX 7600 lands directly in the largest subdivision of Steam users by GPU power level: 13.5 percent as of September 2025. In our opinion, we'd nudge the 0.4 percent of Nvidia GTX 1080 Ti owners into the pool that's comparable to the RX 7600, mostly because the latter has support for DX12 Ultimate features. Thus, that largest bump on the chart jumps slightly to 13.9 percent.

Unless Valve has truly figured out how to turn its cut-down RX 7600 into a clear 10-15 percent frame-rate winner over this pool of GPUs by way of SteamOS and Steam Machine optimisations, we're not so sure this pool of users will see a meaningful performance upgrade with Valve's new living room box. A lateral sidegrade isn't an easy sell.

It's when we pool together the next combination of users that we see Steam Machine's existing-user opportunity. An additional 27.9 percent of Steam users land below that performance level but still in a "low-end" pool of GPUs. Beneath even that is the "potato" GPU tier, which makes up 3.5 percent of Steam users' GPUs.

(There's also the matter of the survey not accounting for 17.8 percent of GPUs, which could range from the lowest-end, deprecated GPUs to the highest-end custom systems outside average consumers' range, but we can't say either way.)

Roughly 30 percent of invested Steam users are logging in regularly and hanging on at quite a low tier of PC performance - and these are cost-conscious customers, relying largely on the same 8GB VRAM GPUs that we have struggled to recommend over the past few years. For existing Steam users, then, this system's unified architecture, streamlined SteamOS experience and "Steam Machine verified" promise could put them over the top to upgrade. Though, again, probably not at a high price.

When we asked a follow-up question about its choice of an 8GB VRAM GPU, a Valve rep was pointed in his response: "We want to keep the price point where it is." Meaning, Valve isn't interested in selling a performance-based Steam Machine SKU to roughly 36 percent of Steam users with better-than-Machine specs.

Looking back, Microsoft was prescient to roll out a cheaper, cut-back Xbox Series S back in 2020. Meaning, there was no way the Series X spec was going to get cut down to the $299 sweet spot like in prior console generations to spur lower-price investment in current-gen Xboxes. The generational norm of increased PC and console power at lower prices has hit a relative standstill since then, and it's one that the Steam Hardware Survey reflects. PC owners aren't jumping in power at reasonable prices the way they used to, yet they're still buying and enjoying games.

And while we at DF love seeing the state of the art in modern PC games, along with scalability to higher-end PCs, we know Steam's top-sales charts are dominated by games that scale downward; as but one example, this year's Battlefield 6 on PC underwhelmed us on a technical level but has also lapped up historic sales figures. Steam Machine is positioned to let new Steam users join that millions-of-players fray with system specs that align with a massive, existing audience who may not be upgrading computer parts for a while.

Let's rewind to what we know about Steam Deck, as far as potential Steam Machine pricing is concerned. Does it make a profit? Is there a combination of loss-then-revenue as per a traditional console's razor-and-blades sales model?

Valve has been careful not to publicly confirm a Deck attach rate - meaning, a clear connection between Steam game sales and Steam Deck ownership. (Valve loves telling developers how to optimise their games for better sales figures, yet at the August developer-centric SLICE Expo in Seattle, its pair of Valve-led panels didn't mention Deck-sales metrics.) We also imagine the stats experts at Valve have built spreadsheets around Steam's games with either exclusive, first-time or majority playtime on Deck hardware.

Valve has also been careful never to confirm our long-held and educated suspicion that Deck launched as a loss-leader in 2022. Still, we have statements made to IGN by Valve's Gabe Newell and Shreya Liu in 2021 that described a "painful" and "very important" price point. Newell further suggested that phrases like "our margins are too thin" had "never" entered the Deck-pricing conversation.

Newell also mentioned "excitement" from manufacturing "partners" about "the PC community pushing into this space." But we're not sure if that meant Valve successfully bargained for cheaper component prices, with said partners making that compromise so they could later pump out even more Deck-like APUs and components to a newly excited consumer audience.

Valve reps hinted to that hypothesis in our Steam Machine interview series, when we described SteamOS's eventual graduation to higher-priced portable systems like the Lenovo Legion Go. "We expect this will be a bit of the same thing [for Steam Machine], where SteamOS is ready for discrete PCs, with discrete GPUs, AMD hardware and a bunch of different configurations," one Valve rep said. "You might see other third parties do different price segments or performance segments with the SteamOS experience."

Estimating Steam Machine's material cost, then, is hard to do without accounting for Valve's bargaining power at this point in the SteamOS success story. Notice that Valve mentions "AMD" as the default chipmaker for any third parties' Steam Machine-like devices to follow. AMD has been tidily walking down the road that Valve has paved in the form of smooth SteamOS compatibility for their silicon on Deck-like devices in the past two years. Here they are again, enjoying a namecheck and default Steam Machine placement. Lucrative stuff for them, and arguably worth a long-term arrangement to continue producing Machine's older RDNA 3 GPU.

Valve has another edge: a direct consumer connection via Steam. You'll have to buy Steam Machine via Valve's popular storefront, same as Valve Index, Steam Deck and other devices before it. That's not just saving Valve the usual cost-per-unit paid out to big-box retailers; Valve can further reduce costs in the supply chain via tweaks big and small. (In one example, Steam Deck's own box uses plain, non-flashy cardboard, since it doesn't have to look fetching at a storefront.)

Put all of that together, and we can confidently guess that Valve has entertained razor-thin profit margins with its Steam Deck line. And Valve didn't disabuse us of that notion.

Launching multiple devices three years out from Steam Deck with "affordability" as a tagline suggests that Valve knows what price point will move Steam Machine inventory - and that it's an aggressive point. And we feel comfortable assuming that Valve's internal data tells them every Steam Deck sold leads to overall higher operating profit - especially if Valve has avoided increasing Deck model prices at the same cadence as other PC device manufacturers.

So it's reasonable for Valve to have PlayStation 5's current $499 base price in its sights - a figure it can potentially match or beat based on specs, manufacturing manoeuvres, potential tariff avoidance and cash reserves to absorb a loss-leader price.

Comments 10

It's a bit of a conundrum. The Steam DECK absolutely felt like an enthusiast device, being able to play a lot of your Steam library on the go. But the Steam MACHINE doesn't seem to be targeted at that same group of players, the specs are just too low for most enthusiasts.

I am sure there will still be some enthusiasts who still want it, whether to use as the ultimate emulator box, or for other reasons, but for most it's unlikely to replace their PCs. I do wonder how it will fare with a different target group.

I said on the other thread I thought they would be aiming from £500+ depending how bullish they were being. I guess we will have to wait and see.

Personally I would have been there day 1 if it was around £750+ with a 16GB GPU and a little more GPU grunt. As it is I likely won't be buying... but then... I said the same about the Deck!

The specs matter to enthusiasts, but for broader appeal it just has to work. I really did not enjoy the online discussions on whether something ran well on the steam deck and I'm anticipating more along those lines for the steam machine, given that both devices are fairly resource constrained. At its hardware class though, I anticipate that low/medium settings upscaled from 1080p (RT off) should be enough for nearly every game (minus poor PC ports). Getting people to dial in these settings is another matter.

I'm very interested in one, even though I have a high-end PC. The poor experience of trying to play games on my TV using my windows desktop has made me appreciate the value of a controller-navigable OS (or a OS-navigable controller, as you will). I hope they can manage to get the price down. ~$600 is still (borderline) attractive to me.

@Lotus_DF I think the problem is they effectively have 2020 hardware specs in a device coming out in 2026 and the bar will likely be raised in 2027 with next-gen consoles.

Yes it will be likely be a decent entry level gaming PC, but it’s not hard to want a bit more.

@themightyant Well the GPU's nearly a RX 7600, right? That's more like 2023. Moreover, it's hard to imagine that the next generation won't have an even larger cross-gen period than this one. I really think that the software experience and price are stronger considerations when appealing to the mass-market. Especially when considering the hardware / economically constrained market we're in, and possibly going to be in for a while.

Not to deny that the GPU feels anemic. Moreover, if we're going to be up-scaling, I wish I could be doing so with DLSS. I hope the driver situation re. NVIDIA+Linux gets better, a high end steam machine sounds fantastic. Last I looked, it's still around a 15% performance penalty when running NVIDIA hardware on linux.

@Lotus_DF with DF analysis pointing towards somewhere between Xbox S/S and PS5 performance it very much has more of a 2020 smell about it than a 2023 whiff. I too am struggling to know who this is targeted at, and indeed, why so much fanfare apart from it’s an ‘open’ platform compacted into a nice form.

@Lotus_DF I meant “2020” more in terms of performance than the actual year the hardware release dates, but I take you point. It just looks so backwards thinking when the specs sit at the mid point of the hardware steam chart before it even releases. Surely you want a reasonable upgrade? So who is that for?

Yet I agree that low cost could be the deciding factor that makes it sell, but I also think the low specs might be the thing that holds it back. As I said it’s a bit of condunrdum. We’ll have to wait and see.

But I am excited about what the device COULD be in future. Whether that’s a third party “Steam Machine” or a more Pro aimed model.

I think I’m definitely in the minority here, but as someone who’s only PC gaming hardware is a Steam Deck, I’ll be buying this day one regardless of cost (short of it being $1,000+ bucks). I’ve been toying with the idea of a compact gaming pc build, but have been put off by costs. If i can get an ultra compact gaming desktop with discrete graphics for 600-700 bucks, then I’ll be pleased. I think this will be the last generation of game consoles for me, and I can fully transition to steam hardware and pc gaming and no longer have to pay for multiplayer and cloud saves. Exciting stuff!

Did I dream this or hear it on some YouTube video, that Valve will sell the Steam Machine sans a controller … with the assumption that you have an Xbox or PlayStation or other controller laying around, as these are all compatible.

That would give it a lower 'entry price'.

Not to say they won't sell a bundle with the controller too, but this might be a tactical option to give a "from $499" price tag.

@SteamyDeck Steam OS still has problems with multiplayer games reliant on anti-cheat though, so hopefully this is something that devs can fix, but it currently stands as a big issue.

@LawrenceMurray agreed. For me personally, that mostly doesn’t affect the games I play. For the ones that aren’t on Linux, I’ll play them on the ps5 for the foreseeable future.

Show Comments

Leave A Comment

Hold on there, you need to login to post a comment...